How to Use Market Research to Outperform Your Competitors: A Step-by-Step Guide for African and Middle Eastern Markets

Market research is no longer a luxury—it’s a necessity. In a business world that’s increasingly data-driven, intuition alone won’t help you keep up with the competition. Today’s top-performing businesses use research not just to understand customers but to track competitors, anticipate market shifts, and seize new opportunities before others even notice them.

Whether you’re launching a startup, managing a growing enterprise, or trying to reposition an existing brand, market research gives you the insights you need to make smarter, faster, and more profitable decisions.

At Research 8020, we’ve helped organizations across Africa and the Middle East make strategic leaps through customized market and social research solutions. In this guide, we’ll show you how to practically and effectively use market research to outperform your competitors—step by step.

Why Market Research Gives You a Competitive Advantage

Markets are constantly evolving. Consumer preferences shift. Competitors innovate. New entrants disrupt. Without research, you’re making decisions in the dark. With it, you gain visibility—into your market, your audience, and your rivals.

Market research empowers businesses to:

Understand customer needs and pain points

Track competitors’ strengths, weaknesses, and strategic moves

Identify trends and opportunities before they peak

Fine-tune products, pricing, and promotions for optimal results

Make evidence-based decisions instead of relying on assumptions

According to Harvard Business Review, companies that adopt data-driven decision-making are not only more profitable, but also more innovative. In markets like Kenya, Nigeria, Saudi Arabia, and the UAE—where digital transformation is accelerating—research is often the difference between a successful strategy and a costly mistake.

Step 1: Identify Your Competitors

The first step in any competitive research project is defining exactly who your competitors are. Most businesses have both direct competitors (those offering similar products or services) and indirect competitors (those offering different solutions to the same customer need).

Start by asking:

Who offers a similar product or service in your market?

What alternatives might your customers choose instead of you?

Who dominates customer attention on digital platforms?

To identify competitors effectively, conduct a simple audit:

Search for your service or product keywords on Google and LinkedIn

Browse online marketplaces or directories in your niche

Interview or survey your customers to find out who else they considered

Tools like SEMrush, SimilarWeb, and Google Trends can also help identify competitors you might not be aware of—especially online.

Step 2: Collect Relevant Data

Once you’ve identified your competitors, the next step is collecting meaningful data. The goal here is to understand not just what your competitors do—but how they do it, how well they do it, and what gaps they may be leaving behind.

There are two main types of data to gather:

1. Quantitative Data: Hard metrics such as pricing, product range, delivery time, social media followers, ratings, and reviews.

2. Qualitative Data: Deeper insights such as customer sentiment, tone of voice in communication, brand messaging, and perceived customer service quality.

Sources to consider:

Competitor websites and landing pages

Social media platforms (check how they engage their audience)

Review platforms like Google Reviews, Trustpilot, or HelloPeter

Customer interviews or surveys

In-store visits (for retail and hospitality sectors)

Industry publications and reports

You can also run your own customer perception surveys using online tools like Typeform or SurveyMonkey, or work with professional research agencies to conduct focus group discussions (FGDs) and key informant interviews (KIIs).

Step 3: Analyze Trends and Spot Opportunities

Data without analysis is just noise. The next step is to synthesize what you’ve learned into patterns, gaps, and opportunities.

A useful method is the SWOT analysis framework, which helps you look at your business in the context of your competitive environment:

Strengths – What advantages do you currently have?

Weaknesses – Where are you underperforming?

Opportunities – Are there untapped customer segments or underserved needs?

Threats – What competitor activities could erode your market share?

This step also includes trend analysis:

Are customers shifting toward digital-first experiences?

Are competitors using influencers or short-form video content?

Is there a gap in the market for localized solutions?

For example, one of our clients in the e-commerce sector in Nairobi discovered, through competitor and customer analysis, that none of their competitors offered mobile money payment integration for rural areas. By introducing M-Pesa as a primary payment option and expanding delivery to underserved counties, they gained a 25% sales increase in just three months.

Step 4: Apply Your Insights to Strategy

All the research in the world is only useful if you act on it. This is where insights become strategy.

Use the findings to:

Adjust your pricing or packaging

Refine your brand messaging

Launch a product feature that addresses a competitor weakness

Enter an under-served geographical area

Rethink your marketing channels

One of the best frameworks to help convert insights into actions is the Insight-to-Action Matrix. Here’s an example you can use:

| Insight | Action | Expected Outcome |

|---|---|---|

| Competitors lack a loyalty program | Launch a customer rewards scheme | Improve retention by 15% |

| Customers complain about slow response times | Invest in WhatsApp Business automation | Reduce support time and increase satisfaction |

| Market prefers eco-friendly packaging | Introduce biodegradable materials | Attract conscious consumers and elevate brand image |

Remember, the competitive edge often lies in the small refinements, not just big leaps.

Step 5: Track Performance and Iterate

Market research is not a one-time event. Industries change, competitors evolve, and customer expectations shift. To stay ahead, you must monitor outcomes and adjust continuously.

Best practices include:

Regular customer feedback loops (monthly or quarterly)

Post-launch performance analysis (what worked, what didn’t?)

Quarterly competitor benchmarking

Campaign A/B testing to measure the effect of research-informed changes

There are plenty of tools you can integrate into your workflow, including Hotjar for behavioral analytics, SurveyMonkey for customer feedback, and Tableau for visualization and decision dashboards.

FMCG Brand Expansion in West Africa

A consumer goods company looking to expand into Ghana and Côte d’Ivoire approached Research 8020 for support. We conducted competitor pricing research, ethnographic studies, and brand awareness surveys.

Findings revealed:

Local competitors priced significantly lower, but lacked digital engagement

Rural consumers preferred radio marketing over online ads

Packaging was perceived as foreign and unappealing

Our recommendations led to:

A value-pack SKU designed for price-sensitive consumers

Radio and in-market activations in regional languages

Redesigned packaging that aligned with cultural preferences

The brand grew its regional sales by 32% in the first 6 months and increased market share by outperforming both local and global competitors.

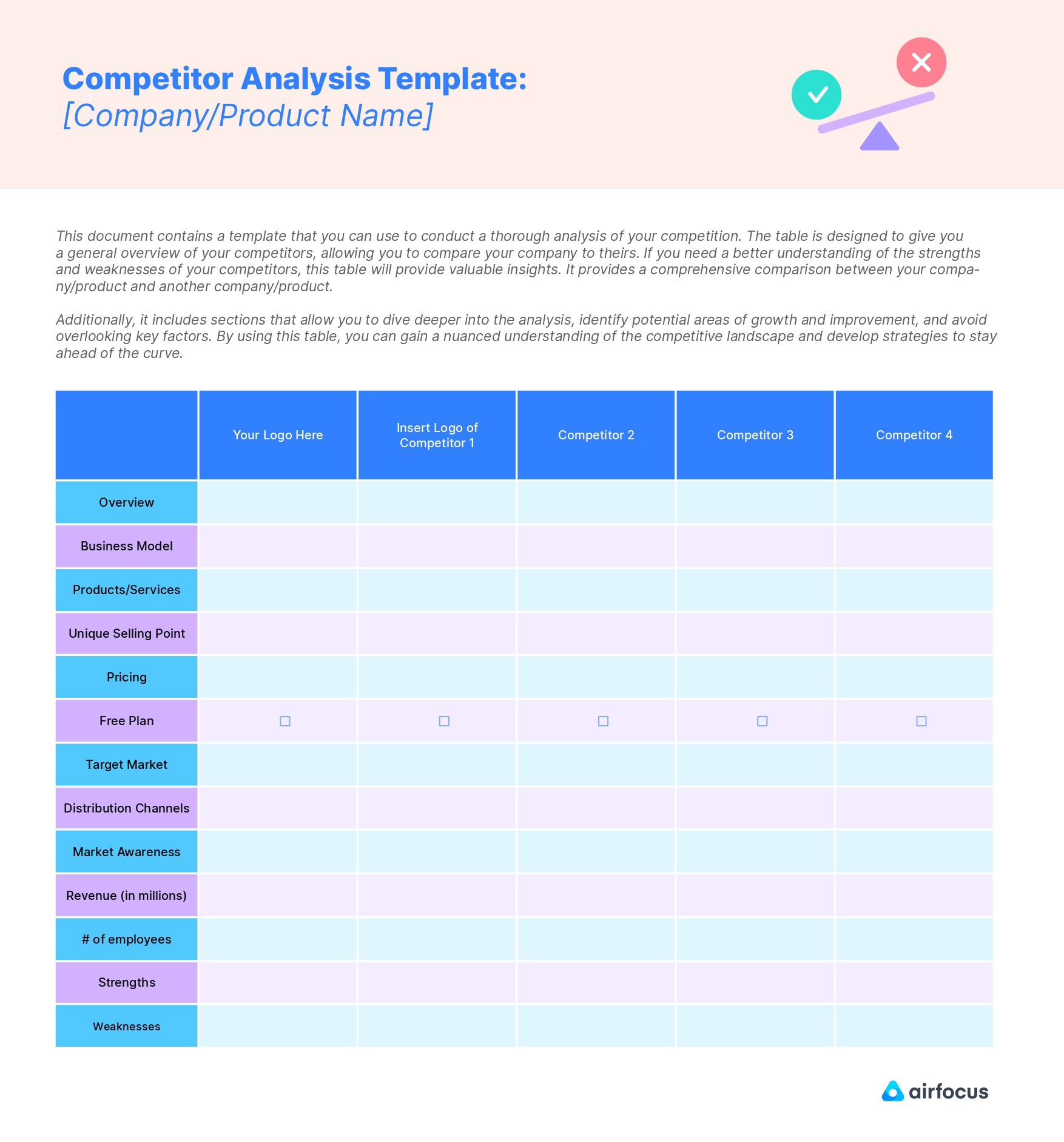

Competitor Research Template

Use this simple template to start tracking your competitors today:

Competitor Name:

Product/Service Offered:

Target Audience:

Strengths:

Weaknesses:

Pricing Strategy:

Marketing Channels:

Customer Perception (based on reviews or surveys):

Opportunities for Differentiation:

Download the template: Competitor Research Sheet (PDF)

Final Thoughts: Move from Guesswork to Growth

If you’re not actively conducting market research, you’re playing a guessing game—while your competitors use data to get ahead. But the good news is: it’s never too late to start.

Businesses that commit to regular, data-driven decision-making are more likely to survive, grow, and lead. Whether you’re a startup founder, marketing manager, or development professional, market research gives you the clarity and confidence to make your next move the right one.

At Research 8020, we’ve helped businesses across Africa and the Middle East translate research into real results. From brand health tracking and customer satisfaction surveys to social program evaluations and impact assessments—we make data work for you.

Ready to turn insights into competitive advantage?

Let’s talk.

Discover how we can help you outpace your competition, one insight at a time.